When thinking about your customers, it’s useful to apply the Pareto Principle. This is also known as the 80/20 rule, and is named after Italian economist Vilfredo Pareto, this principle states that around 80% of the output from any given situation is determined by just 20% of the input.

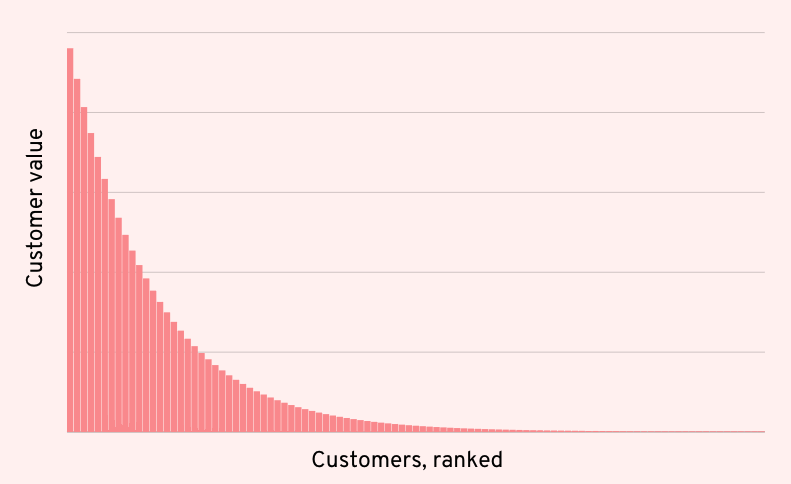

Pareto reached his conclusion after observing that 20% of the peapods in his garden held 80% of the overall peas. Translating this into ecommerce talk, this suggests that 80% of your revenue comes from only 20% of your customers. This means you have a long tail of customers that looks a little like this:

The exact number will vary from brand to brand, but the principle that looking after and retaining your best customers will take care of most of your revenue holds firm. But how do you go about actually identifying your best customers?

There are a number of different approaches you can take, from dabbling in RFM (recency, frequency, monetary value) analysis to using advanced behavioural clustering. We’ll take a look at one specific method here.

In order to accurately identify your best customers, it’s vital to have a full picture of all their interactions with your store – one that takes into account both on and offline purchases, but also other data sources, like marketing engagement and browsing behavior.

Incorporating returns data is also key to identifying your best customers, as the true amount they’ve spent with you (their customer lifetime value) is an important factor in distinguishing whether they’re a VIP or not – and you need to be careful rolling out the special treatment to serial returners.

You will also want to incorporate other data, such as social engagement, number of orders, product or categories bought, and referral data.

Bringing all of this data together – cleaning it, deduplicating it, identifying the different devices someone shops on – forms the basis of achieving a single customer view (sometimes called a ‘total’ or ‘360’ customer view). With this in place for each customer you can start comparing them.

With all of your customer data in one place, it’s nearly time to perform the analysis needed to reveal the criteria that determines whether a customer is considered a VIP or not.

Before this happens, however, it’s important that you remove any customers that may skew your results, for example:

With outliers excluded, the next step is to start ranking your customers. The simplest way to do this is to rank them according to their customer lifetime value (CLV), which is the total amount they have spent with your store (we’ll discuss some extra criteria that you may wish to rank them by in the next step).

Now it’s time to decide who falls under the VIP category.

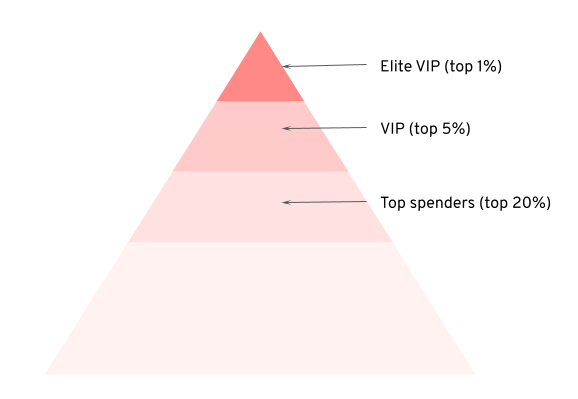

At Ometria, we tend to start with a benchmark of your top 5% of customers for the VIP category. You may also wish to segment further, for example calling your top 20% ‘top spenders’ and your top 1% ‘elite VIPs’.

Another way to look at it is with the Pareto Principle in mind, and going from the top, work out which customers contribute 80% of your revenue in a given period.

This may come in handy both for reporting on the health of your customer base, and also for targeting these groups with special campaigns.

By looking at the lowest amount spent for each tier, you will be able to determine the minimum CLV to be eligible for VIP status, and create segments accordingly.

Take note that this amount can change over time, so we advise reassessing the number annually or biannually.

While CLV is a good starting point, you may want to tweak the above model to match your business. For example, you may want to take into account:

Frequency

For some stores – particularly those that sell replenishable items, or have a relatively low AOV (high street fashion, for instance), including an element of frequency into your VIP category criteria may be advisable. For instance, you may consider someone to be a VIP if they have a CLV of over £300 AND have made more than two purchases.

Some retailers find it useful to keep a separate list of single-purchase customers who spend enough to reach VIP status in a single order, as paying these big-spenders special attention in order to keep them buying and spending more is still incredibly important.

Likewise, if you’re a retailer that sells products with a long lifespan and a long selling cycle, such as furniture, then you might want to consider making a customer a VIP if they’ve bought from two different categories; for example, a bedside table as well as a bed.

Recency

You may also want to factor how recently someone has made a purchase into your VIP category criteria.

One more advanced way of defining your VIP category is by ranking, say, your top 5% of customers by CLV (1-50, for example, with a customer base of 1000), then do the same for frequency (number of orders) and the same for recency. You can then combine these lists and take the top 50 as your VIP customers, giving equal weight to each of these factors

Your VIP customers are probably your most sacred sources of revenue, so it’s paramount you know them by name, and have strategies in place for keeping them engaged with your brand.

With your ranking of VIPs, you can start creating dedicated campaigns towards them taking into account their individual preferences. You can also examine what common characteristics they have that your non-VIPs don’t, and try to encourage other customers to take similar action. For instance, we’ve observed among our customers’ data that subscribed customers tend to have a higher CLV than non-subscribed customers. Encouraging visitors to subscribe could be a way to bring people into that VIP category.

While focusing on VIPs is important, it’s important to recognize that it is a snapshot, and that customers who are in your ‘long tail’ can become VIPs over time, so you need a strategy that incorporates them as well.

Ometria is committed to protecting and respecting your privacy, and we’ll only use your personal information to administer your account and to provide the products and services you requested from us. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

Take the first step toward smarter customer marketing