We all stumble through life clutching onto the fuzzy memories of those pesky Pythagoras and algebraic theorems that haunted many a youth, and—with rare use cases in present day life—they normally end up getting filed and forgotten.

Enter customer lifetime value: the only equation you need to remember.

In ecommerce, CLV is the value a customer contributes to your business over their entire lifetime at your company.

The main methods of calculating CLV are split between historic and predictive CLV:

Historic CLV (Good indication of CLV)

Simply the sum of the gross profit from all historic purchases for an individual customer.

Predictive CLV (Great indication of CLV)

A predictive analysis of previous transaction history and various behavioural indicators which forecasts the lifetime value of an individual. As long as the equation is accurate, this value will become more accurate with every purchase and interaction.

Customer lifetime value is one of the most important metrics in your tool belt if you’re an ecommerce retailer.

We all know that it’s more costly to acquire new prospects than to retain existing ones – thus extending your CLV is central to a healthy business model and customer retention strategy.

Don’t believe us? Here are five reasons why employing CLV as a central metric is vital if you want to increase profitability, retention and overall ecommerce success.

1. Generate real ROI on customer acquisition

CLV helps you focus on the channels that give you the best, most profitable customers. You should be optimising your marketing channels in terms of the lifetime value a customer contributes to your brand, rather than the gross profit on the initial purchase.

You are therefore trying to maximise your customer lifetime value in relation to your cost of customer acquisition (CLV:CAC).

Focusing on CLV will change the economics of your customer acquisition strategy. Suddenly you can pay a lot more to acquire a customer because you are not held back by the profit generated from a single purchase, but from the purchases made over a lifetime with your brand.

Information about your customers with the highest CLV (known as your VIP customers) will also give you insight into exactly who you should be targeting in terms of demographic.

Factoring CLV into your strategy is a recipe for success, and will leave all your less data-driven competitors in the dust while you’re busy ruling and dancing in your ecommerce disco (which you threw because you rule).

2. Enhance your retention marketing strategy

The value of a marketing campaign (for example, one aimed at turning your one-time purchasers into repeat customers) should not just be valued on the instant revenue they drive. It should be valued in terms of what impact it had on the average CLV of the segment of customers you are targeting.

How did it alter the trajectory of CLV over time for an average customer? To calculate this, you’ll need accurate predictive analytics so that you can see how predicted CLV is influenced by different marketing actions.

3. Create more effective messaging, targeting & nurturing

Segment your customer base by CLV so that you can improve the relevance of your marketing with more personalised messaging.

A useful variable to use here would be the types of products you market to your customers from different segments.

4. Improve your behavioural triggers

By organising data into natural groupings (or clusters) you can discover the behavioural triggers that incentivised your best customers to make their first purchase.

Once you’ve taken a look at your beautiful results, you should be trying to replicate this behaviour with your prospective customers in order to turn them into first-time purchasers.

5. Improve output from customer support

Focus your time on giving special attention to your most valuable customers. Never forget Pareto’s handy little principle: 20% of your customers generate 80% of your revenue.

Using CLV to identify your most valuable customers will help you decide where to direct your customer service resources. Paying attention to your most valuable (and profitable) customers will help you push up margins, at the same time as fostering strong relationships through better service with your most important segment.

|

Read more in our ecommerce metrics series |

This is simply the sum of the gross profit from all historic purchases for an individual customer. Sum all gross profit values up to transaction N where transaction N is the last transaction a customer made with your store. If you have access to all your customer transactional data you can calculate this in Excel or, if you want to save time and have this calculated automatically through software, you should try a tool such as Ometria.

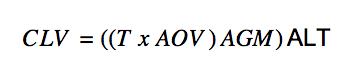

(AGM = Average Gross Margin)

Calculating CLV based on net profit ultimately gives you the actual profit a customer is contributing to your store. This takes into account customer service costs, cost of returns, acquisition costs, cost of markeitng tools etc. The issue with this is that it can be highly complex to calculate this on an individual basis, especially if you want the figures to constantly be up to date. Gross margin CLV will still give you great insight into the true profitability of your customers to date.

Predictive CLV algorithms try to obtain a more accurate value of CLV through predicting the total value a customer will eventually give to your store over their entire lifetime.

Confused? Ecommerce expert, Vladimir Dimitroff, explains:

“CLV is always the NPV (net present value) of the sum of all future revenues from a customer, minus all costs associated with that customer.”

In practice this can be hard to achieve due to the requirement for up to date discount rates. There are numerous ways to calculate a predictive CLV that vary wildly in complexity and accuracy however we will focus on a couple of examples here. Simple and Detailed.

Simple

Where:

T = Average monthly transactions

AOV = Average order value

ALT = Average Customer Lifespan (in months)

AGM = Average gross margin

Let’s call the above equation gross margin contribution per customer lifespan (GML).

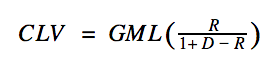

Detailed

Where:

R = monthly retention rate

D = monthly discount rate

Be aware that these models will never be exactly right, they are just forecasts. To quote Vladimir again:

“Predictive techniques…are always limited to the horizon of our models’ predictive accuracy and confidence.”

Having said this the more tailored your CLV equation is to your specific industry the more accurate it will likely be. The best models are highly accurate. It is essential to do these calculations to get a real understanding of how valuable your customers actually are, the more accurate you become the more powerful your marketing can be.

One important factor the previous equation misses out on is the ongoing costs to your business for retaining a particular customer. You would need to calculate this in order to get a net value for CLV.

In addition, the most complex predictive models make increasingly more accurate CLV figures based on how a specific individual continues to interact with your store. Taking into acount both interaction and transactional information.

As we know, not every individual is the same—some are a lot more valuable than others; as you gather more data about an individual, you can determine with increasing accuracy what sort of individual they are likely to be: High, Medium, Low value etc.

This is where artificial intelligence comes in. As mentioned in our AI ebook, supervised learning can be used to forecast a customer’s lifetime value. How does this work? An machine learning algorithm will draw on all of the behavioural data available, as well as existing lifetime values, to develop and train a model which can be used to predict the lifetime value of an individual customer.

Ometria is committed to protecting and respecting your privacy, and we’ll only use your personal information to administer your account and to provide the products and services you requested from us. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

Take the first step toward smarter customer marketing